INFLATION REDUCTION ACT (IRA)

The One Big Beautiful Bill Act (OBBBA), signed into law on July 4, 2025, significantly reshaped the landscape for clean energy incentives. While federal credits for residential geothermal have expired, commercial geothermal heat pump (GHP) incentives remain a powerful tool for reducing capital costs and accelerating ROI for U.S. businesses and non-profits.

Immediate Action Required: The June 30 Deadline

To maximize your tax benefits, pay close attention to the following 2026 milestones:

- Section 179D Deduction: This deduction (up to $5.94 per sq. ft. in 2026) is only available for projects that begin construction by June 30, 2026.

- Safe Harbor: To secure the full 30% Investment Tax Credit (ITC) for larger systems, construction should commence by July 4, 2026.

Geothermal Federal Tax Guide

- Investment tax credit (ITC) up to 30% of the system cost basis

- Domestic content bonus tax credit up to 10% of the system cost basis

- Energy community bonus tax credit up to 10% of the system cost basis

- Direct-pay option for non-taxable entities

- No cap on total credit amount

- Can be used to offset AMT tax

- Can be used for more than one year

- Can be carried back up to three years or transferred/sold to an unrelated party

- Can be combined with solar and other clean energy tax credits

Additional State and Local Geothermal Energy Tax Incentives Available

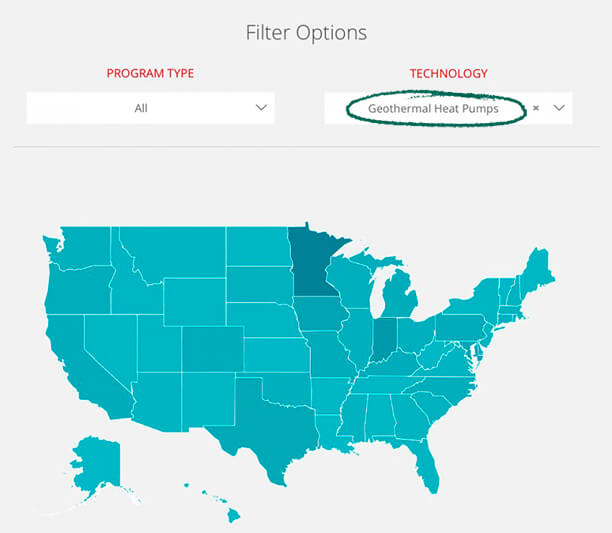

Check with your your state and local governments! There may be additional incentives for installing a ClimateMaster geothermal heating and cooling system. Visit the DSIRE Website (link below) shown below to find out if there are state and local commercial and residential energy tax credits available in your area.

NOTE: Once you reach the DSIRE Website, simply select “Geothermal Heat Pumps” from the “Technology” drop down menu and then click on your state to view all the programs or energy credits available for geothermal heat pumps in your state.

ClimateMaster, Inc.

7300 SW 44th St

Oklahoma City, OK 73179

800.299.9747

Learn more about other Climate Control Group companies

CCG | ClimaCool | ClimateCraft | IEC

© ClimateMaster, Inc. All rights reserved 2024