SAVE MORE WITH GEOTHERMAL

%20ClimateMaster%20Logo%20-%20White%20-%20No%20Tag%20-%20Small.png)

Save 30% On Your Geothermal Heat Pump System!

In addition to experiencing the cost saving efficiency of a geothermal heating and cooling solution, there are now immediate cost savings available to make your investment more affordable. Homeowners can now receive 30% on the installation of new geothermal systems with federal tax credits offered because of the Inflation Reduction Act legislation passed in August of 2022. But hurry! The credit ends December 31, 2025

Claiming the Credit

IRS Form 5695 is used to claim the Residential Energy Credit. Links to the form and pertinent reference documents are below:

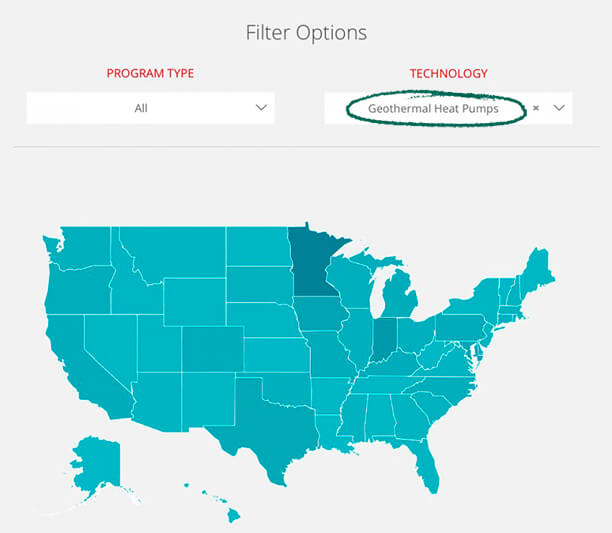

State Incentives. Local Rebates. Save Even More.

With national efforts for decarbonization and electrification, many states are offering tax credits to homeowners in addition to the federal IRA incentives. Also, because of the increased efficiency of geothermal systems and the reduced demand on power grids, many utility companies are rewarding their customers with significant rebates on their electric bill.

Visit the DSIRE Website (link below) shown below to find out if there are state and local residential energy tax credits available in your area.

NOTE: Once you reach the DSIRE Website, simply select “Geothermal Heat Pumps” from the “Technology” drop down menu and then click on your state to view all the programs or energy credits available for geothermal heat pumps in your state.

ClimateMaster, Inc

7300 SW 44th St

Oklahoma City, OK 73179

800.299.9747

© ClimateMaster, Inc. All rights reserved 2024