ClimateMaster News

The most educational residential HVAC blog in the country, providing, HVAC systems articles and videos, as well as information on geothermal systems.

Questions Answered: Federal Tax Credits and Local Incentives for Residential Geothermal Installation

Published By: Joe Parsons

What is the 2021 geothermal tax credit?

EDITORS NOTE: This has been superceded by the Residential Clean Entergy Property Credit, which is a 30% tax credit for certain qualified expenditures made by a taxpayer for residential energy efficient property under the Inflation Reduction Act of 2022. This incentive ends December 31, 2025

Helping provide incentives for homeowners to make energy-efficiency home improvements, the federal government and some local utility companies offer tax credits as a way to offset the costs of these repairs or changes, and they’ve just extended their timeline. This is not cash in your hand (like a rebate that gives you cash back after you’ve made a purchase), but a credit you can claim on your annual tax return that may reduce the federal taxes you pay as a homeowner.

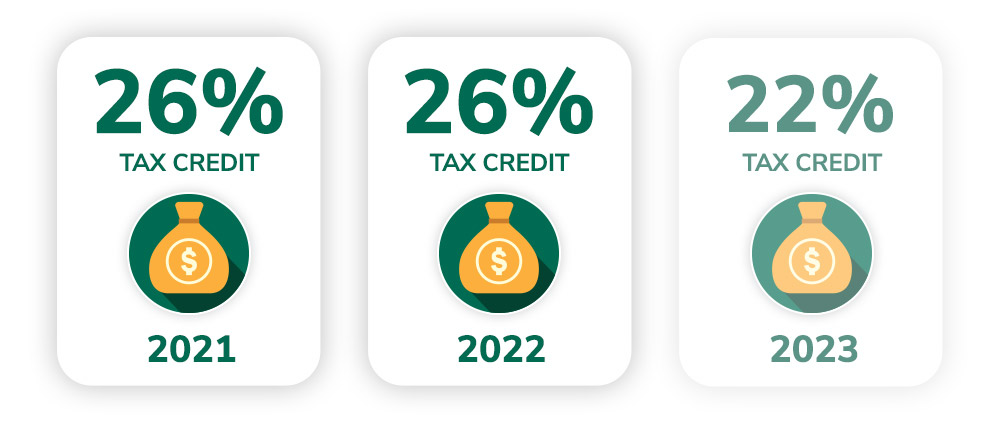

Since geothermal systems are the most efficient heating and cooling units available, the United States federal government has enacted a 26% federal geothermal tax credit with no upper limit. In a massive environmentally-focused year-end bill, congress announced on December 21, 2020, that they would extend its federal tax credit for residential ground source heat pumps (GSHP) installed before 12/31/2022. The bill was signed into law on December 27 by president Donald Trump.

The credit will lower to 22% in 2023, and for commercial GSHP systems, deductions will remain at 10% if construction starts before 1/1/24. Also, the 179D “Energy-efficient commercial buildings deduction” is made permanent and adjusted for inflation in the future.

How do I qualify?

If you’re installing geothermal into your home within the given timeframe the government has now extended, your unit must meet the Energy Star program requirements that are in effect at the time of expenditure.

EnergyStar.gov provides a comprehensive list of which geothermal heat pumps meet their qualifications for tax credits.

How do I claim my tax credit?

Claiming a geothermal tax credit is as simple as filing your taxes next year. The IRS issues federal tax credits themselves. When submitting a tax return, file Form 5695 under Residential Energy Credits to get credit for your geothermal heat pump.

For more information about the process of claiming your tax credit, visit constellation.com for a homeowners’ guide to tax credits and rebates. It’s always a good idea to consult your tax professional for best practices in claiming credits.

Can I use the tax credit on multiple homes or rental properties?

You must install the geothermal heat pump in a home you own and use as a residence. Both existing homes and new construction will qualify for the tax credit. Principal residences and second homes qualify but do not include rental properties.

Are there additional local incentives?

Some states offer additional incentives for residents and commercial property owners to enhance their clean energy efforts. To find out more about which programs your state offers you as a homeowner, visit the Database of State Incentives for Renewables & Efficiency®

What qualifies for a geothermal tax credit?

A Qualified Geothermal Heat Pump Property means any equipment which uses the ground or groundwater as a thermal energy source to heat the dwelling unit or as a thermal energy sink to cool the dwelling unit, and also meets the requirements of the Energy Star program, which are in effect at the time the equipment is installed.

Be sure to ask your geothermal installer to verify that your heat pump meets the Energy Star program’s requirements. All labor costs associated with installing the geothermal heat pump, and any associated materials (piping, wiring, etc.) are also included.

It’s clear that our government is making strides to help its citizens take action in reducing their carbon imprint on the planet. If you’ve been considering geothermal heating and air conditioning in your home, there’s no better time to invest.

ClimateMaster, Inc

7300 SW 44th St

Oklahoma City, OK 73179

800.299.9747

© ClimateMaster, Inc. All rights reserved 2024